Free School Meals - Government Guidance

Guidance for local authorities, maintained schools, academies and free schools

Summary

About this guidance

This is guidance from the Department for Education. This advice is non-statutory, and is designed to help recipients understand their obligation to provide free school meals to disadvantaged pupils in maintained schools, academies, and free schools in England.

This guidance can be read alongside technical guidance on the Department's Eligibility Checking System (ECS) and guidance on free meals in Further Education.

What legislation does this guidance refer to?

- The Education Act 1996

- The Welfare Reform Act 2012

- Children and Families Act 2014

Who is this guidance for?

- Local authorities

- School leaders, school staff and governing bodies in all maintained schools, academies and free schools

Main Points

The Government recognises the benefits of providing a healthy school meal to the most disadvantaged pupils. The Education Act 1996 requires maintained schools and academies (including free schools) to provide free school meals to disadvantaged pupils who are aged between 5 and 16 years old.

- Transitional protections were initially enacted with an end date of March 2022, the date the rollout of Universal Credit was due to end. When the end date moved to March 2023 the Government extended the protections in line with this date. As the rollout is continuing, the end date for transitional protections is being further extended to March 2025.

- This means that pupils who were eligible on 1 April 2018, or who became eligible since then, continue to receive free meals, even if their household is no longer eligible under the benefits/low-earnings criteria, up until March 2025 and then until the end of their phase of education

- New applicants for free school meals on or after 1 April 2018, who are in receipt of Universal Credit and have earnings above the earned income threshold, will not be eligible for free school meals.

- We want to make sure as many eligible pupils as possible are claiming their free school meals, and to make it as simple as possible for schools and local authorities to determine eligibility. To support this:

- we provide an Eligibility Checking System (ECS) to make the checking process as quick and straightforward as possible for schools and local authorities.

- we have developed a model registration form (at Annex A) to help schools encourage parents to sign up for free school meals.

- we also provide guidance to Jobcentre Plus advisers so that they can make Universal Credit recipients aware that they may also be entitled to wider benefits, including free school meals.

Eligibility criteria for free school meals

Section 512 of the Education Act 1996, as amended, places a duty on maintained schools, academies and free schools to provide free school meals to pupils of all ages that meet the criteria.

Who is eligible for free school meals?

Free school meals are available to pupils in receipt of, or whose parents are in receipt of, one or more of the following benefits:

- Universal Credit (provided you have an annual net earned income of no more than £7,400, as assessed by earnings from up to three of your most recent assessment periods)

- Income Support

- Income-based Jobseeker's Allowance

- Income-related Employment and Support Allowance

- Support under Part VI of the Immigration and Asylum Act 1999

- The guarantee element of Pension Credit

- Child Tax Credit (provided you're not also entitled to Working Tax Credit and have an annual gross income of no more than £16,190)

- Working Tax Credit run-on - paid for four weeks after you stop qualifying for Working Tax Credit

In addition, the following pupils will be protected against losing their free school meals as follows:

- Since 1 April 2018, all existing free school meals claimants have continued to receive free school meals whilst Universal Credit is rolled out. This applies even if their earnings rise above the threshold during that time.

- In addition, any pupil gaining eligibility for free school meals after 1 April 2018 will be protected against losing free school meals until March 2025.

- After March 2025, any existing claimants that no longer meet the eligibility criteria at that point (because they are earning above the threshold or are no longer a recipient of Universal Credit) will continue to receive free school meals until the end of their current phase of education (i.e. primary or secondary).

A pupil is only eligible to receive a free school meal when a claim for the meal has been made on their behalf and their eligibility, or protected status, has been verified by the school where they are enrolled or by the local authority.

Children receiving education otherwise than at school (EOTAS)

Under section 61 of the Children and Families Act 2014, local authorities can arrange for 'any special educational provision' for children and young people otherwise than in school in circumstances where it would be 'inappropriate' for the provision to be made in school - referred to as 'EOTAS1EOTAS is distinct from elective home education, where parents have chosen to provide education for their children at home or elsewhere instead of sending them to school full time'. These packages of support are put in place by local authorities, typically as part of a child's education, health and care plan (EHCP).

No specific provision is made in legislation for free school meals to be provided to children who are in receipt of EOTAS.

We expect local authorities to consider making equivalent food provision for children who are receiving EOTAS under section 61 of the Children and Families Act 2014 who meet both of the following criteria:

- the child would meet the benefits-related criteria for free school meals if they were in a state-funded school (for more information see pages 5-8 of this guidance)

and

- the meals would be provided in conjunction with education and would, in line with the aim of free school meal provision, be for the purpose of enabling the child to benefit fully from the education being provided.

Once this consideration has been made, local authorities should then assess the individual circumstances of the child to decide whether and how such provision can be made.

In considering their approach to making food provision for relevant children, and in making decisions on particular cases, local authorities should act in accordance with the Human Rights Act and the European Convention on Human Rights and comply with the public sector equality duties.

Local authorities may draw upon the Dedicated Schools Grant (DSG) in order to fund such food provision. Paragraph 34 of Schedule 2 to The School and Early Years Finance and Childcare (Provision of Information About Young Children) (Amendment) (England) Regulations 2024, permits expenditure incurred in relation to, or in connection with, education provided other than at a school or post-16 institution under section 61 of the Children and Families Act 2014 to be retained centrally from the DSG by a Local Authority.

Assessment of earnings for Universal Credit recipients

Applicants for free school meals who are in receipt of Universal Credit must have an equivalent annual net earned income of no more than £7,400 in order to be eligible for free school meals. The monthly checking arrangements outlined below are designed to take into account claimants whose earnings may fluctuate on a monthly basis.

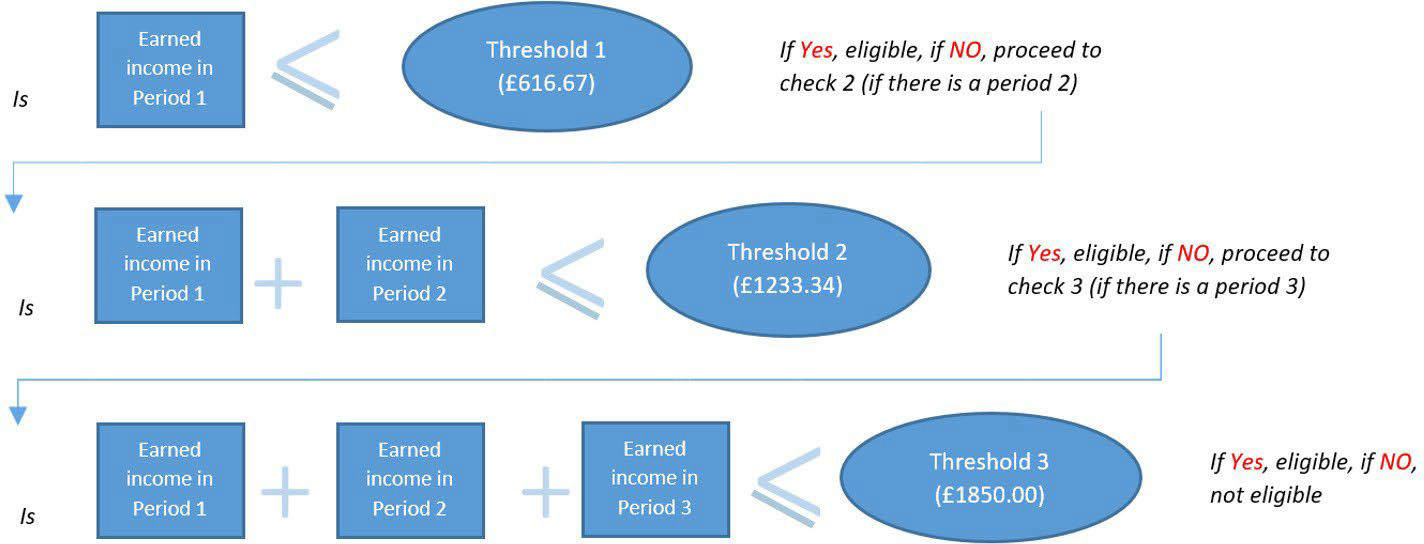

- Firstly, a Universal Credit claimant will be checked for monthly net earned income not exceeding £616.67 (a twelfth of an equivalent yearly income of £7,400) in their most recent Universal Credit assessment period. If they meet this criterion, they are eligible for free school meals and no further checks are necessary;

- If their earned income exceeds the above threshold for their most recent Universal Credit assessment period, the claimant will be checked for net earned income not exceeding £1,233.34 (a sixth of an equivalent yearly income of £7,400) in their two most recent assessment Universal Credit assessment periods, provided there are two such assessment periods. If they meet this criterion, they are eligible for free school meals and no further checks are necessary;

- If their earned income exceeds the above threshold for their two most recent Universal Credit assessment periods, the claimant will be checked for net earned income not exceeding £1,850 (a quarter of an equivalent yearly income of £7,400) in their three most recent Universal Credit assessment periods, provided there are three such assessment periods. If they meet this criterion, they are eligible for free school meals.

- If Universal Credit recipients do not meet any of these criteria, they will be ineligible for free school meals.

Only complete assessment periods will be checked.

A manual check will be required to determine eligibility for self-employed Universal Credit claimants. These claimants will need to provide evidence that:

- They are in receipt of Universal Credit, by providing their Universal Credit award letter;

- They are self-employed, by providing a copy of their company registration or tax return form;

- Their monthly net earnings do not exceed the threshold as set out above. Schools should request that self-employed claimants complete the self-declaration attached at Annex B and, once satisfied that they are eligible, provide free school meals to their child/children.

Schools or local authorities seeking further guidance on this process can contact the Eligibility Checking System helpdesk.

Encouraging free school meal registration

We want to make sure as many eligible pupils as possible are claiming their free school meals, and to make it as simple as possible for schools and local authorities to determine eligibility.

To receive free school meals, a claim must be made by the pupil, their parent or another responsible adult, before the pupil becomes entitled. We know that many schools and local authorities have established very effective ways to encourage all eligible families to register for free school meals.

The Department provides the Eligibility Checking System (ECS) to make the checking process as quick and simple as possible for schools and local authorities.

To encourage parents and guardians to register for free school meals, schools and local authorities may wish to use our updated model registration form for paper-based applications at Annex A. We will continue to highlight and disseminate best practice from the schools and local authorities who are most effective at encouraging free school meal registration on Gov.uk and through our newsletters.

We also provide guidance to Jobcentre Plus advisers and work coaches so that they can make Universal Credit recipients aware that they might also be entitled to free school meals.

Checking eligibility

The responsibility for checking the eligibility of applicants for free school meals rests with the individual school. However, many schools will choose to work with local authorities to carry out these checks via our simple Eligibility Checking System.

Schools and local authorities, where appropriate, should record the date on which they receive the initial application for free school meals from a parent or guardian.

Eligibility checks should be carried out promptly to ensure that the most accurate and up-to-date information is being utilised.

Schools may choose to receive applications by paper or online. Whilst online applications can be more efficient, schools and local authorities should have an alternative system for those who cannot access an online system.

Eligibility Checking System

All local authorities have access to the Department's Eligibility Checking System (ECS), which provides a simple and rapid online portal for determining households' eligibility for free school meals, and other early education entitlements.

The ECS allows local authorities to quickly check data held by the Department for Work and Pensions, the Home Office and HMRC to establish eligibility for free school meals.

This system has been updated to reflect the new eligibility criteria and will conduct a check under Universal Credit by looking back at up to three months of assessment periods to determine eligibility. Local authorities can find further guidance on the ECS Knowledge Hub, which is available on the ECS portal.

Maintained schools, academies and free schools are all able to use the ECS through local authorities.

If a parent feels that the result returned by the ECS is inaccurate, they may provide the equivalent paper-based evidence to their local authority who must then complete a manual check.

- For Universal Credit recipients, this check should assess the earned income from the months provided against the thresholds stated above for the relevant assessment periods.

- For recipients of other benefits, the check should assess whether the claimant is currently in receipt of the stated benefit and, in the case of Child Tax Credit, that their annual gross income is no more than £16,190.

Applicants must provide appropriate paper based evidence from the list below. Local authorities can award free school meals if they are satisfied that the paper based evidence demonstrates that the eligibility criteria are met. Evidence should be retained for audit purposes.

Paper-based evidence

There may be instances when parents need to submit paper-based evidence in support of their free school meals claim. This may be especially relevant for families claiming under income-based benefits, or when they are unable to submit information through the online Universal Credit system.

For families that might be eligible for free school meals under Universal Credit, applicants should provide:

- a copy of their Universal Credit award statement (from their most recent assessment period(s) - going back a maximum of three assessment periods).

The three relevant Universal Credit assessment periods would be the three complete assessment periods which immediately preceded the date on which the parent requests free school meals.

For families that are eligible for free school meals under Child Tax Credit or a legacy benefit, applicants should provide:

- a letter from Jobcentre Plus confirming eligibility or Income Support payment book;

- a final Tax Credit Award Notice (TC602) from HM Revenue & Customs.

For families that are eligible for free school meals under Part VI of the Immigration and Asylum Act 1999 or the guarantee element of the Pension Credit, applicants should provide:

- a letter from the Home Office stating that they are receiving support under Part VI of the Immigration and Asylum Act 1999;

- a 'Pension Credit M1000 Award Notice' clearly showing details of any Guarantee Pension Credit in payment.

Further details on eligibility for free school meals for families with no recourse to public funds (NRPF) can be found here.

Arrangements for providing meals

Alternative arrangements to providing meals in school

In meeting their legal duties to provide free meals to eligible children, we expect schools to routinely offer a healthy and nutritious meal in school for their pupils. We recognise, however, that in limited exceptional circumstances, this may not always be possible - such as during school closures as a result of unavoidable school building closures and/or attendance restrictions. For such temporary circumstances, where education is still being provided, alternative arrangements can be made such as the provision of food parcels or vouchers.

Duty to make reasonable adjustments for disabled children

There may also be specific instances where the individual needs of pupils on roll at a school restrict them from accessing meals. This may be as a result of their disability. Schools have a duty under the Equality Act 2010 to make 'reasonable adjustments' for disabled pupils to prevent them being put at a substantial disadvantage in comparison with pupils who are not disabled2Equality Act 2010 (legislation.gov.uk). For schools, this includes taking reasonable steps to avoid a disadvantage arising from a provision, criterion or practice applied by them; and, where the absence of an auxiliary aid would give rise to a disadvantage, to take reasonable steps to provide the auxiliary aid. This is an anticipatory duty and so schools need to actively consider whether any reasonable adjustments are needed in order to avoid any disadvantage that may otherwise occur.

Schools are required to make reasonable adjustments for disabled pupils on roll at a school to ensure they are not put at a substantial disadvantage in relation to accessing meals where appropriate. This includes disabled pupils who are eligible for free school meals. Schools are required to make such adjustments as are reasonable to enable such pupils to access their free school meal entitlement.

Schools should work with the pupil, their family and any other professionals involved, to agree the necessary support.

Schools are best placed to determine the exact nature of a reasonable adjustment in relation to food provision, taking into account the individual circumstances of the child and their family, as well as schools' obligations under the School Food Standards3School Food Standards: Resources for Schools (gov.uk). It is good practice for the school to make a record of what reasonable adjustments have been agreed and ensure that all staff who work with the individual pupil are aware.

It is also recommended that the reasonable adjustments are regularly reviewed to make sure that they are effectively helping individual pupils while at school. The support should be adjusted if the individual pupil's needs change.

Where a child has Special Educational Needs (SEN) and is either in receipt of SEN Support or has an education, health and care plan (EHCP), the disadvantage they experience may be overcome by support received under the SEN framework. In other cases, a disabled pupil may need reasonable adjustments to be made in addition to their special educational provision. It may be appropriate to review such adjustments with the parent either through the regular SEN Support meetings or the formal EHCP reviews.

Illustrative examples of reasonable adjustments (not exhaustive)

A child has Autism which results in sensory processing difficulties leading to a restricted diet. As a result, the child is unable to access free school meals which comply with the relevant food standards. The school, having engaged with the parent/carers and the child, determines that a suitable reasonable adjustment would be to issue food vouchers to the child's parents so they can provide a packed lunch that the child will eat.

A child has Avoidant Restrictive Food Intake Disorder (ARFID) and therefore will only eat a particular type of sandwich. The child is therefore unable to access free school meals that the school provides which comply with the relevant food standards. The school, having engaged with the parent/carers and the child, determines that a suitable reasonable adjustment would be to provide the particular type of sandwich that the child eats on a daily basis so that the child doesn't go hungry.

Making alternative arrangements for non-disabled children

Schools are not obliged to make reasonable adjustments for children who are not disabled.

However, Section 100 of the Children and Families Act 2014 places a duty on governing bodies of maintained schools, proprietors of academies and management committees of PRUs to make arrangements for supporting pupils at their school with medical conditions - which may be food-related, for example a pupil may have a food allergy. Schools should similarly therefore take appropriate action in supporting such pupils to access food provision.

Further information and advice

For more information on reasonable adjustments please see:

- Equality Act Guide for Schools - Council for Disabled Children

- Reasonable adjustments for disabled pupils - Guidance for Schools in England - Equality Human Rights Commission

- For pupils with medical conditions, including allergies please see: Supporting pupils with medical conditions at school - GOV.UK (www.gov.uk)

- For more information on supporting pupils with allergies, please see Allergy guidance for schools - GOV.UK (www.gov.uk)

- For more information on the School Food regulations, please see School food standards: resources for schools - GOV.UK (www.gov.uk)

- For children who cannot attend school due to health needs, please see Education for children with health needs who cannot attend school - GOV.UK (www.gov.uk)

Free school meals for infants and 16-18 year-olds

Universal Infant Free School Meals

Since September 2014, state funded schools in England have been required by law (Children and Families Act 2014) to provide free lunches to pupils in reception, year 1 and year 2, who are not otherwise entitled to benefits-related free school meals. Like other school meals, universal infant free school meals must meet school food standards in maintained schools; similarly academies and free schools are required to comply with the standards.

Further guidance on funding arrangements for universal infant free school meals is available here. An online toolkit to help schools deliver universal infant free school meals available here.

Free meals in Further Education

The 1996 Education Act requires further education (FE) funded institutions to provide free meals to disadvantaged students. Further guidance on eligibility criteria and funding arrangements for free meals in further education is available here.

Further information

Useful resources and external organisations

Online toolkit for Universal Infant Free School Meals

Other relevant departmental advice and statutory guidance

Eligibility Checking Service guidance

Guidance for local authorities on pre-16 schools funding

16 to 18 education: free meals in further education

Other departmental resources

Free school meals and pupil premium: model registration form for schools